8 Tips To Help Agencies Get Paid Faster

In business, cash is the undisputed king. Even if you generate strong revenue and incur reasonable expenses, without a steady cash flow you’ll inevitably face troubled times.

This is especially true for agencies that often bill for work after it’s been completed. In essence, you are financing your own services for the client. Knowing that money is outstanding is much different than seeing it in your bank account.

A steady cash flow lets you satisfy financial obligations on time; avoid costly late payments, higher interest rates or default; and ideally build a cash reserve that can be leveraged for:

- Capital Expenditure Investments: Banks look to see how much collateral you can put down when securing financing. The more cash you can show, the easier it will be to get the funding needed to purchase new equipment, facility enhancements or locations. In some cases, you may be able to avoid the bank all together.

- Company Acquisition: Whether you’re looking to aggressively grow or are presented with a once-in-a-lifetime opportunity, you’ll need cash (and lots of it) to purchase another business.

- Survival During Downturns: When economic times are tough, and you’re struggling to keep up with bills, having a reserve of cash to tap into can help you meet financial obligations. These are the businesses that survive and come out on the other end.

For agency owners, all of this is no secret. But, how many of you have structured financial processes, mechanisms and technologies in place to help ensure this consistent influx of cash?

In this post, we’ll discuss eight tips to help ensure you get paid for your work in a timely and consistent fashion.

-

Embrace online technology

Cloud-based technologies are ideal for effective and profitable agency management.

These systems can automate a large portion of the data collection, notification and reporting process. In addition, different systems can be connected via APIs so there is a seamless flow of up-to-date information from one system to another.

For example, an all-in-one agency management system like WorkflowMax enables agencies to track leads, create quotes, track time and costs, manage projects, create purchase orders, and send invoices electronically—everything in one integrated system.

How does connecting all your online tools help you get paid faster?

The quicker and more seamless your business processes, the faster the time between closing that new client and sending that first invoice.

In many companies, jobs get held up at different stages of the process because there is admin work to be done, and no one wants to do it—instead, with the click of a button, the task can move down the chain.

The flexibility of cloud-based technology gives you the ability to craft your own end-to-end system, cutting back on admin time and consolidating all the job-related info in one place—great for quickly answering those payment queries and getting the money in the bank faster.

-

Keep on track with debtors

Stay on top of those who owe you money. Put a process in place for follow-up communications when a client has an overdue invoice. Define the process that works best for your agency, and stick to it.

While many of us are uncomfortable confronting clients about overdue bills, the reality is, it’s your money.

You’ve done the work. You’ve sent the invoice. You can’t be afraid of asking for it.

There are a number of Debtor Tracking Software options that can automate the awkward follow-up process with clients by connecting with your accounting software.

Also, check out some of the email templates in this ebook to help in writing these communications.

-

Agree on payment terms before you start a project

Have an initial conversation with the client about what will be included in the invoice, payment terms and due dates.

Set expectations and make sure both parties are clear at the onset of the relationship to avoid confusion down the road.

-

Keep detailed records of time

In the agency world, you sell time. Having a detailed record of the total tracked time against specific projects is important for creating invoices.

This is especially true when clients are expecting to see time included as part of their invoice. Utilize time tracking tools to capture and record time investments and associated hourly rates against a project or client.

-

Make the invoice clear and easy to understand

The client shouldn’t have to search for how much they have to pay, who to direct payment to, and what they are paying for.

This information should be clearly and concisely detailed on the invoice without a lot of design or unnecessary text to inadvertently conceal it.

Want tips on how to lay out your invoice to get paid faster? Check out this article that contains 7 tips on how to improve your invoicing process.

-

Set appropriate payment terms

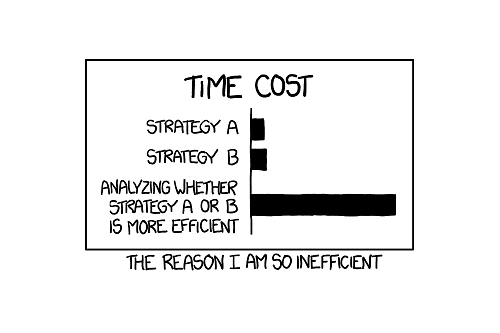

Xero ran a report that pulled 12 million invoices for small businesses over 18 months.

Specifically, it looked at invoice due dates and then when those invoices were paid. On average, payments were received 14-days late.

To receive payment on time, take this research into account.

Consider shortening your payment terms from 30 days to 15, or from 15 days to due upon receipt. By anticipating overdue payments, you can help avoid them.

-

Address the invoice to the person paying

Have a direct conversation with your client to identify who should receive the invoice so you can avoid having to forward your email to several different contacts.

Define the contact’s name, department, address, required project details and a P.O. number (if needed) up front so the first invoice can be paid right away.

-

Invoice as soon as possible

As soon as the work is approved and client is happy, send the invoice.

If you’ve setup a streamlined process using a project management software, you don’t have to wait till the end of the month to send an invoice.

At the touch of a button, convert your time sheets into an invoice or create one using a percentage of quoted value.

Ensuring the long-term financial strength of your agency requires committing to daily review of the cash flow in and out of your agency.

The more you can adhere to a process, utilize available technologies and streamline information sharing and reporting, the easier this commitment is to follow through.

Written by Chirag Ahuja

Chirag Ahuja is the Marketing Manager at WorkflowMax. He is passionate about delivering a seamless and personalized experience to every customer. In his spare time, Chirag loves listening to techno music, reading Vedic scriptures, leading teams, building relationships, and discussing the big questions in life. Connect with Chirag on LinkedIn.